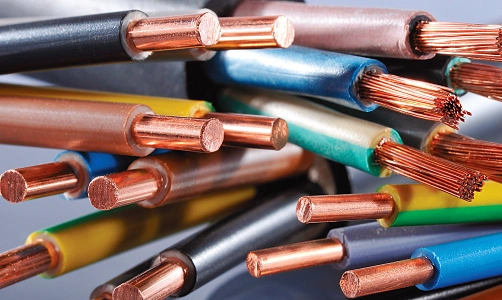

Today India’s wire and cable industry stands as one of the most critical enablers of infrastructure, power, and urban development. Almost every growth story in the economy—housing, renewable energy, railways, electric vehicles, data centres, telecom, and manufacturing—depends on wires and cables. Though largely invisible to end consumers, the sector forms the backbone of electricity transmission, communication networks, and industrial connectivity.

What defines the wire and cable industry in 2026 is broad-based demand with rising quality expectations. Volumes are growing steadily, but the real shift is toward safer, higher-grade, and application-specific products. Fire-resistant cables, EV-grade wires, optical fibre, and renewable-energy cables are gaining prominence. At the same time, the industry faces pressure from raw material volatility, intense competition, and uneven compliance across players.

This article breaks down the current size of India’s wire and cable industry in 2026, the factors driving its expansion, the problems it faces, and what the future holds.

Quick Overview: Wire and Cable Industry in India (2026)

| Aspect | Status |

| Total industry size | ₹85,000–90,000 crore |

| Annual growth rate | ~9–11% |

| Organised sector share | ~65–70% |

| Major segments | Power, building wires, telecom, industrial |

| Key raw materials | Copper, aluminium, polymers |

| Major demand drivers | Power, infra, housing, renewables |

| Export contribution | ~10–12% of revenue |

| Industry stage | Infrastructure-led expansion |

Industry Size and Structure (2026)

By 2026, India’s wire and cable industry is estimated to be worth ₹85,000–90,000 crore, covering power cables, building wires, control cables, optical fibre cables, and specialised industrial cables. The sector is closely linked to capital expenditure cycles, making it a barometer of infrastructure and industrial activity.

The industry structure is increasingly organised, though a sizeable unorganised segment still exists in low-voltage building wires. Large, branded manufacturers dominate medium- and high-voltage cables, institutional projects, and exports, while smaller players cater to local markets and price-sensitive segments.

Wires and cables can broadly be classified into:

- Building wires for residential and commercial construction

- Power cables for transmission and distribution

- Telecom and optical fibre cables

- Industrial and specialised cables (EV, railways, renewables, oil & gas)

Manufacturing clusters are spread across Gujarat, Maharashtra, Rajasthan, Haryana, and southern India, supported by proximity to raw materials, ports, and consumption centres.

Key Growth Drivers in 2026

1. Power and Transmission Infrastructure

Expansion of power generation, transmission, and distribution networks remains the single largest growth driver. Grid upgrades, underground cabling, and rural electrification projects continue to create sustained demand for power cables.

Renewal of ageing power infrastructure is also supporting replacement demand.

2. Housing and Real Estate Development

Residential and commercial construction directly drives demand for building wires and low-voltage cables. Safety awareness is pushing consumers toward branded, flame-retardant, and low-smoke wires.

Urban housing projects and commercial real estate developments are key contributors to volume growth.

3. Renewable Energy Expansion

India’s rapid expansion of solar and wind capacity is creating strong demand for specialised DC and AC cables. Solar parks, rooftop installations, and wind farms require durable, weather-resistant cables.

This segment is growing faster than the overall industry and offers better margins.

4. Electric Vehicles and Charging Infrastructure

EV adoption is emerging as a structural growth driver. EV manufacturing plants, charging stations, and battery systems require high-quality, heat-resistant cables.

Though still a small base, this segment is expanding rapidly.

5. Telecom and Data Infrastructure

Growth in data consumption, 5G rollout, and data centres is supporting demand for optical fibre and communication cables. Fibre deployment continues in both urban and rural areas.

Data centres, in particular, require high-performance power and control cables.

Segment-wise Performance

a. Building Wires

Building wires account for a large share of volumes. Demand is steady and replacement-driven. Branding and safety certifications are increasingly important purchase criteria.

b. Power Cables

Medium- and high-voltage power cables are used in transmission, distribution, and industrial projects. Demand is project-driven and closely linked to government spending cycles.

c. Telecom and Optical Fibre Cables

This segment benefits from digitalisation and network expansion. While margins fluctuate, volumes remain strong due to ongoing fibre rollout.

d. Industrial and Specialised Cables

Specialised cables for railways, metros, EVs, renewables, and oil & gas are the fastest-growing segment. These products require technical expertise and offer higher margins.

Competitive Landscape

The wire and cable industry is moderately consolidated at the top, with large organised players controlling a significant share of value. Companies such as Polycab India and KEI Industries benefit from scale, brand trust, and strong distribution networks.

Smaller and unorganised players compete primarily on price in low-end segments but face increasing pressure due to safety regulations and customer awareness.

Exports are handled mainly by large players with international certifications and quality compliance.

Key Challenges in 2026

1. Raw Material Price Volatility

Copper and aluminium prices are highly volatile and form a major portion of product cost. Sudden price swings impact margins and working capital requirements.

2. Thin Margins and Price Competition

Despite strong demand, competition keeps margins under pressure. Government and infrastructure tenders are often awarded on lowest-price criteria.

3. Compliance and Safety Enforcement Gaps

While standards exist, enforcement is uneven. Substandard and counterfeit wires still circulate in some markets, affecting industry reputation and safety outcomes.

4. Working Capital Intensity

The industry is capital-intensive, with high inventory and receivable cycles. Smaller players struggle with financing, especially during commodity price upswings.

5. Import Dependence for Raw Materials

India depends heavily on imported copper and certain polymers. Currency fluctuations and global supply disruptions affect cost stability.

Structural Shifts Visible in 2026

Several long-term changes are shaping the industry:

- Shift toward branded and certified products

- Growing demand for fire-safe and low-smoke cables

- Expansion of specialised and application-specific cables

- Increasing export orientation among large players

- Gradual decline of low-quality unorganised products

The industry is moving from commodity supply to safety- and performance-led demand.

Forecast: Wire and Cable Industry Outlook (2026–2030)

Short-Term Outlook (2026–2027)

- Strong demand from power, housing, and renewables

- Continued raw material price volatility

- Market share gains for organised players

Medium-Term Outlook (By 2030)

By 2030, India’s wire and cable industry could exceed ₹1.4 trillion in size. Growth will depend on:

- Sustained infrastructure and power investments

- Expansion of renewable energy and EV ecosystems

- Stricter safety enforcement and quality standards

- Improved domestic sourcing of raw materials

Value growth is expected to outpace volume growth as specialised cables gain share.

Final Perspective

In 2026, India’s wire and cable industry is no longer just a supporting sector—it is a strategic pillar of the country’s infrastructure and energy transition. Demand visibility is strong, but success depends on quality, compliance, and cost management.

Manufacturers that invest in technology, strengthen brands, and align with emerging sectors such as renewables, EVs, and data infrastructure will shape the next phase of growth in this essential industry.