In 2026, India’s battery industry has moved from being a supporting segment of electronics and automotive manufacturing to a strategic backbone of the country’s energy and mobility transition. Batteries now power electric vehicles, store renewable energy, support telecom networks, enable consumer electronics, and provide backup power for homes, hospitals, and data centres. Very few industries today sit at the intersection of so many critical sectors.

What defines the battery industry in 2026 is rapid expansion under technological change. Demand is accelerating across segments, large investments are underway, and government support is strong. At the same time, the industry is grappling with raw material dependence, fast-evolving battery chemistries, safety concerns, and the challenge of building a competitive domestic supply chain.

This article examines the size of India’s battery industry in 2026, the forces driving its growth, the challenges shaping the sector, and how the industry is likely to evolve over the coming years.

Quick Overview: Battery Industry in India

| Aspect | Status |

| Total industry size | ₹1.6–1.8 trillion |

| Annual growth rate | ~14–16% |

| Key chemistries | Lead-acid, lithium-ion |

| EV-linked demand share | ~35–40% |

| Import dependence | High for cells & minerals |

| Manufacturing focus | Shift from packs to cells |

| Major demand sectors | EVs, renewables, electronics |

| Industry phase | High-growth transition stage |

Industry Size and Structure

By 2026, India’s battery industry is estimated to be worth ₹1.6–1.8 trillion, covering lead-acid batteries, lithium-ion batteries, energy storage systems, battery packs, imports, assembly, distribution, and recycling. The sector has expanded rapidly as batteries have become central to mobility and energy strategies.

The industry is structured primarily around battery chemistry:

- Lead-acid batteries continue to serve automotive starter batteries, telecom towers, and backup power systems.

- Lithium-ion batteries dominate value growth, driven by electric vehicles, consumer electronics, and stationary storage.

- Energy storage systems (ESS) are emerging as a new category, supporting renewable energy integration and grid stability.

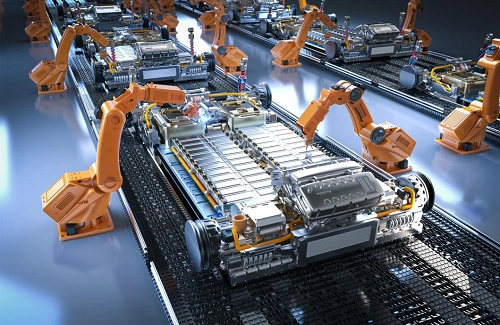

Until recently, India’s role was largely limited to battery pack assembly and integration. By 2026, the shift toward domestic cell manufacturing has begun, marking a major structural change in the industry.

Key Growth Drivers in 2026

1. Electric Vehicle Adoption

Electric vehicles are the strongest growth driver for the battery industry. Two-wheelers and three-wheelers are scaling rapidly, while electric buses and passenger cars are steadily gaining traction. Batteries account for a significant share of EV cost, making performance, safety, and durability critical.

As EV penetration increases, battery demand is rising not just in volume but also in technical sophistication.

2. Renewable Energy and Grid Storage

India’s expanding solar and wind capacity has created a growing need for energy storage. Batteries are increasingly used to balance intermittent power generation, manage peak demand, and stabilise grids.

Grid-scale battery storage is moving from pilot projects to commercial deployment, opening a new long-term demand channel.

3. Consumer Electronics and Digital Infrastructure

Smartphones, laptops, wearables, and connected devices continue to rely on lithium-ion batteries. Telecom towers, data centres, and digital infrastructure also require large-scale battery backup systems.

While growth here is more stable than EVs, the base demand remains very large.

4. Policy Support and Manufacturing Incentives

Government incentives aimed at advanced battery manufacturing have encouraged investments in large-scale plants. The focus is on reducing import dependence, building domestic capability, and creating export-ready capacity.

This policy support has accelerated capital inflows and long-term planning across the industry.

5. Rising Need for Reliable Power Backup

Urbanisation, commercial buildings, hospitals, and critical infrastructure require uninterrupted power supply. Batteries remain essential for backup solutions, particularly in areas with grid instability.

Segment-wise Performance

a. Lead-Acid Batteries

Lead-acid batteries remain widely used in starter applications and stationary backup systems. Growth is modest, but replacement demand ensures steady volumes.

However, margins are affected by lead price volatility and environmental compliance costs.

b. Lithium-Ion Batteries

Lithium-ion batteries are the fastest-growing segment by value. Demand is driven by EVs, energy storage, and portable electronics. Pack assembly is increasingly local, but cell imports still dominate.

Performance improvement, cost reduction, and safety enhancement are key focus areas.

c. Energy Storage Systems (ESS)

ESS is one of the most promising segments. Large projects linked to renewable energy, utilities, and industrial consumers are shaping demand. Business models are still evolving, and project execution requires high capital and technical expertise.

d. Battery Recycling

Battery recycling is gaining importance due to environmental concerns and raw material recovery. While still developing, recycling is expected to become a critical part of the battery value chain.

Competitive Landscape

The battery industry is capital-intensive and technology-driven. Competition includes established Indian manufacturers, global battery companies, and new entrants backed by large conglomerates.

Competitive strength depends on:

- Technology choice and chemistry expertise

- Manufacturing scale and cost control

- Safety and quality standards

- Supply chain resilience

Indian players are strong in lead-acid batteries and pack assembly, while advanced lithium-ion cell technology is still developing.

Key Challenges in 2026

• Dependence on Imported Raw Materials

Lithium, cobalt, nickel, and other critical minerals are mostly imported. This exposes the industry to global supply risks, geopolitical factors, and price volatility.

• Rapid Technology Evolution

Battery technology evolves quickly. Investments in one chemistry risk becoming outdated as newer, more efficient solutions emerge.

• High Capital and Long Payback Periods

Cell manufacturing and energy storage projects require heavy upfront investment. Long gestation periods and uncertain demand projections increase financial risk.

• Safety and Quality Concerns

Battery fires and failures attract intense scrutiny. Ensuring consistent safety, quality control, and testing across the industry is essential.

• Recycling and Environmental Compliance

End-of-life battery management and recycling infrastructure are still developing. Improper disposal poses environmental and regulatory risks.

Structural Shifts Visible in 2026

Several long-term changes are reshaping the industry:

- Movement from battery pack assembly to full cell manufacturing

- Shift from lead-acid dominance toward lithium-ion value leadership

- Rapid emergence of grid-scale energy storage

- Early exploration of alternative battery chemistries

- Growing focus on recycling and circular supply chains

The industry is transitioning from volume-driven growth to technology- and capability-led competition.

Forecast: Battery Industry Outlook (2026–2030)

Short-Term Outlook (2026–2027)

- Strong demand growth driven by EV adoption

- Continued reliance on imported cells and minerals

- Rising investment in domestic manufacturing capacity

Medium-Term Outlook (By 2030)

By 2030, India’s battery industry could exceed ₹4.5–5.0 trillion in size. Growth will depend on:

- Successful scaling of local cell manufacturing

- Secure access to critical raw materials

- Widespread adoption of energy storage systems

- Advances in recycling and next-generation chemistries

Value growth is expected to accelerate as localisation improves and technology matures.

Final Perspective

In 2026, India’s battery industry stands at a defining crossroads. Demand is strong, policy intent is clear, and investment momentum is building but execution challenges remain significant.

The long-term success of the sector will depend on India’s ability to localise technology, secure supply chains, ensure safety, and build a sustainable lifecycle for batteries. As mobility and energy systems evolve, batteries will remain central to India’s economic and environmental future.